The federal government has released a number of financial supports for small businesses and individuals. Below are links and more information about these programs.

Toronto launches ShopHERE

https://dailyhive.com/toronto/toronto-program-help-local-businesses-free-online-stores

The Canadian Club of Toronto Hosts Webinar with The Honourable Mary Ng, MP, The Canadian Minister of Small Business, Export Promotion & International Trade

Minister Ng discussed the support that is currently being offered to Canadian small businesses, by the government, in light of the Coronavirus pandemic. Below are a number of programs and funding packages that she listed relevant to businesses in the Canadian fashion industry.

Helping Businesses Keep Employees

The Canadian Employer Wage Subsidy (CEWS) is probably the largest initiative currently attempting to help businesses avoid laying off their employees.

As a Canadian employer whose business has been affected by COVID-19, you may be eligible for a subsidy of 75% of employee wages for up to 12 weeks, retroactive from March 15, 2020, to June 6, 2020. This means that if you had to layoff employees, directly as a result of COVID-19 and you did so as of March 15th or after, this wage subsidy will enable you to re-hire those workers at 75% of their regular pay and help prevent further job losses.

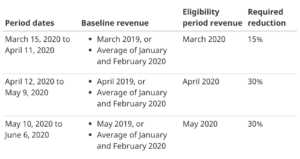

Currently the CEWS is accessible by all businesses regardless of their size or sector but your eligibility is linked to revenue loss. As it currently stands, businesses who have lost a minimum of 15% to 30% of their typical revenues as a direct result of the pandemic. See the graphic below for clarification on the levels of revenue lost.

A calculator is available on the Government of Canada website where you can calculate your eligibility and revenue loss. Click the link above to access the calculator.

Delaying/Extending Payments on Key Moneys Owed

The second area of support identified is the various payments that have been delayed for Canadians. You have probably seen that most banks are delaying mortgage payments, that car and insurance companies are delaying payments, and many other things you typically pay for on a monthly-basis are being delayed or adapted to help you manage through these uncertain times.

From a government perspective, additional delays you should know about are the deferrals of GST/HST remittance payments (these are currently extended until June/July but are constantly re-assessing). The deadline to file your income tax has been extended until June 1, 2020 and payments on your personal and business income tax are have been extended until September 1, 2020.

Ensuring Businesses Can Cover their Operating Costs

Probably the biggest focus of the government right now as it relates to supporting Canadian businesses big and small is ensuring that companies can continue to meet and manage their costs of operation. We know that in these hard times, when all non-essential businesses have been shuttered, casual foot traffic is essentially banned and shopping in general has plummeted, businesses are being hit hard. You have rent to pay, leases to maintain, hydro, water, insurance and internet bills to pay, and so on.

Minister Ng identified that the number one program right now supporting the continued operations of Canadian businesses is the $40,000 interest free loan, also known as the Canada Emergency Business Account (CEBA). This loan is currently available through all banks and you can apply right through your online banking account (if you haven’t set up online banking, now is probably a good time to do so).

The criteria is as follows:

- $40,000 interest free

- $10,000 is forgivable (aka a grant that you don’t have to pay back; regardless of how much you use)

-

- For example: if you apply for the full $40K, only $30K of that needs to be repaid; if you only need $20K, only $10K has to be repaid

- Your payroll dropped to $20,000 as a result of COVID-19, up to a maximum payroll of $1.5million

The loan has to be repaid in full by the end of 2022 (December 31) in order for the $10K to be forgiven. This loan is a start towards supporting a lot of businesses who have the ability to repay such a loan while successfully paying all of their other operational/business expenses. Larger loans are available for certain businesses on a case-by-case basis.

Some Other Key Takeaways We Think You Should Know

Other comments made by Minister Ng that we believe are highly relevant are as follows:

Canada Emergency Response Benefit (CERB)

EVERYONE who has been laid off or experienced significant income loss due to COVID-19 should be applying for the Canadian Emergency Response Benefit (CERB).

Whether you are self-employed, a freelancer or were employed by a business of any kind, if you are making $1,000 or less a month or are completely out of work right now as a direct result of the pandemic YOU QUALIFY.

If you are a business owner who had to lay-off employees you should either be:

- Applying on behalf of your employees through the Employer version (CEWS), or

- You should be guiding your employees through how to apply themselves (CERB)

Canada Emergency Commercial Rent Assistance (CECRA)

Relief and assistance for small businesses in paying their rent is available through the Canada Emergency Commercial Rent Assistance (CECRA). Although the eligibility criteria and application process has not been released yet, Minister Ng confirmed further, robust, support for businesses who need to deal with their commercial leases and rent payments is coming.

You DO Have Power

Often times small and medium sized businesses as well as individuals feel that they have little to no “clout” when it comes to having the government listen to their concerns or needs. Minister Ng acknowledged this in her webinar and made a very clear statement: this idea is false. Now more than ever the doors of government are open, and both provincial (MPP) and federal (MP) representatives are yearning for constant feedback and suggestions on what they are doing and what they could be doing more of.

If you have comments, criticisms, questions, demands, or have identified areas of need not yet addressed by corporate or government response efforts CONTACT YOUR LOCAL / PROVINCIAL / FEDERAL REPRESENTATIVE, because they are in fact listening. Minister Ng provided her most direct contact information → her social media, so if you have thoughts, questions or suggestions, message her @mary_ng or email her office. Email all your government offices. They are listening.

CAF COVID-19 Resource Centre – https://www.apparel.ca/COVID-19_Resources_for_industry.html